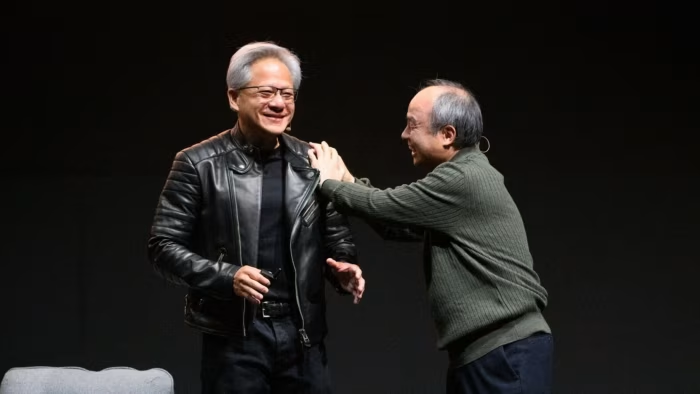

SoftBank has officially sold its entire stake in Nvidia, valued at approximately $5.8 billion, marking the end of its multi-year investment in the U.S. chipmaker. According to recent financial filings, the Japanese technology giant offloaded roughly 32 million Nvidia shares in October 2025. The company clarified that this move was part of a strategy to unlock capital for AI investments, rather than reflecting any doubts about Nvidia’s growth trajectory. The funds are set to be redirected into large-scale projects in AI infrastructure, advanced model development, and robotics.

While the sale raised questions in the market, Nvidia continues to be one of the world’s most valuable companies, maintaining dominance in the rapidly growing AI sector. SoftBank described the move as a “monetize and redeploy” strategy, transforming successful investments into fresh opportunities. The $5.8 billion proceeds will support ventures in AI, including potential partnerships with OpenAI, AI data center development, and other AI-driven technologies. Some experts, however, caution that SoftBank’s aggressive AI focus could signal a potential AI market bubble.

During the same period, SoftBank reported a net profit of ¥2.9 trillion (~$16.2 billion) for the six months ending September 30, 2025 (Q2 FY25), highlighting the company’s continued financial strength despite the Nvidia exit.

This development aligns with SoftBank’s evolving investment strategy, which is increasingly centered on AI technologies rather than high-growth hardware or internet firms. The company has been actively exploring large-scale AI data centers in Japan and beyond. Nvidia, meanwhile, remains unaffected in terms of market position, retaining its leadership in the GPU sector that powers advanced AI applications.

SoftBank is also managing a significant financial load tied to its AI commitments, including the $500 billion Stargate Project. Reports indicate that the company has been leveraging debt financing to fund AI ventures, including a planned $10 billion loan from Mizuho and others to invest in OpenAI, with an additional $30 billion expected by early 2026. Other reports suggest SoftBank may secure up to $16.5 billion in loans to support its AI initiatives in the U.S.

By selling its Nvidia stake, SoftBank is strategically positioning itself to capitalize on the booming AI market, ensuring that its investments are directed toward next-generation technologies with maximum growth potential.